Insuring Talent

为演员投保

When the famous die, it is increasingly costly for insurers

保险公司为名人离世付出的代价日益高昂

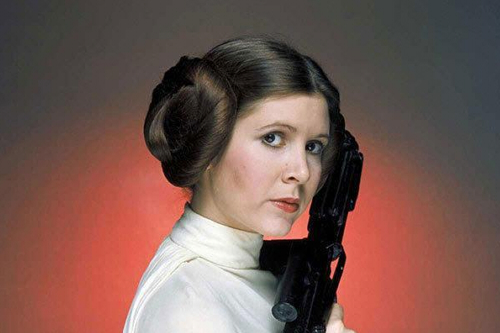

The death of Carrie Fisher, a much-loved actor in the “Star Wars” movies, left a hole in the force for fans. It may also burn a hole in the pockets of underwriters, syndicated under Lloyds of London. They may have to fork out as much as $50m to meet Disney’s claim for its loss. The studio, which owns the sci-fi saga, had wisely taken out so-called contractual-protection insurance (CPI) in case death thwarted a contractual obligation: in Ms Fisher’s case to film and promote future “Star Wars” episodes.

电影《星球大战》中备受喜爱的演员凯丽·费雪(Carrie Fisher)离世,让该系列电影的粉丝们“原力”受损,或许还会令保险公司元气大伤。伦敦保险交易市场劳合社(Lloyds)的会员可能不得不掏出高达5000万美元来满足迪士尼公司提出的索赔要求。拥有《星战》科幻系列电影版权的迪士尼公司此前为防范因死亡而无法履约的情形,明智地购买了所谓的“合约保护险”(CPI)。费雪的合约义务包括拍摄并宣传未来的《星战》续集。

Contrary to the headlines, 2016 was not an especially lethal year to be a celebrity. Like the rest of us, they do die. But unlike most of us, their employers can be left with astronomic bills. When Paul Walker, an actor in “The Fast and the Furious”, a series of action movies, died in 2013 while filming the seventh instalment, Universal Pictures had to spend considerable effort (and dollars) to make his on-screen persona live on. This included hiring body-doubles and digitally inserting Mr Walker into the movie with hundreds of computer-generated images.

不同于各种新闻头条给人的印象,2016年对于明星而言并非什么特别不幸的年份。和我们其他人一样,他们也终有一死。但和我们大部分人不同的是,他们的老板可能会因其死亡而花费天文数字。系列动作电影《速度与激情》的演员保罗·沃克(Paul Walker)在2013年拍摄该片第七部时死亡,环球影业不得不付出大量心血(和美元)让他在荧幕上“复活”:雇用替身,并用成百上千的电脑成像把“沃克”置入电影中。

Most workers are easier to replace. Employers can take out simple life insurance that pays a fixed lump sum. But the value of a film star to a studio, or a striker to a football club, is harder to calculate in advance. It depends on all sorts of things, especially timing. This is where contingency insurance, such as CPI, comes in. Unlike a life policy, how much of the $50m Disney receives depends on how it now calculates and justifies the losses caused by Ms Fisher’s death. This could include, for example, her role in boosting sales of storm-trooper figurines.

大部分员工都更易取代。雇主可以购买简单的人寿保险,将会一次性获赔固定的数额。但是电影公司的一个明星或足球俱乐部的一名前锋的价值更难预先计算。其价值要视各种因素而定,尤其是时机。这里就轮到“合约保护险”这样的意外险登场了。不同于人寿保险,迪士尼最后会拿到5000万美元索赔中的多少,取决于它现在要如何计算和证明因费雪的死亡所造成的损失。比如,这可能包括她在提升帝国突击队人偶的销售量中所起的作用。

Insuring talent is becoming popular outside Hollywood. The aptly named Exceptional Risk Advisors, a company based in New Jersey that reportedly brokered the Fisher policy, also helps insure against the deaths of hedge-fund managers, company executives and sports teams’ star players. Publishers have taken out CPI in case bestselling authors die with books half-written.

为人才投保在好莱坞以外的领域也流行起来。总部位于新泽西的“异常风险咨询”有一个很贴切的公司名字。据称它是费雪这一保单的中介。它还帮助为对冲基金经理人、企业高管、明星球员的死亡投保。出版商们也已经购买了合约保护险,以防畅销书作者写到一半就撒手而去。

Jonathan Thomas, from Munich Re, who has written contingency policies for over 30 years, says they are “exactly what Lloyd’s is good at”. The greatest change he has seen is in the sums involved. But some worry that underwriters are dropping their standards and taking on too much risk. This could well become a problem if contingency insurance grows much larger. But today it is still tiny compared with life insurance.

慕尼黑再保险公司(Munich Re)的乔纳森·托马斯(Jonathan Thomas)签订意外险已逾三十年。他称这类保险“正是劳合社的优势所在”。他目睹的最大变化是其中涉及的金额。但一些人担忧,保险商正在丢弃自己的标准而背负太大的风险。如果意外险的规模扩大很多,这很可能会成为一个麻烦。但目前它和人寿险的规模相比仍然微不足道。

With rock stars remaining on stage into their dotage and long-running sequels one of the surest ways to make money in Tinseltown, the risks of losing a “key human” (or on occasion animal) are growing. That creates business opportunities for insurers, so long as they remain prudent and don’t become star-struck.

摇滚巨星们一把年纪还在舞台上疯狂;好莱坞最保险的赚钱方式之一便是没完没了地拍续集。失去“关键人物”(或者有时是动物)的风险正在上升。这为保险商创造了机遇,只要它们保持审慎行事,别让自己追星不成反而被死星砸到。

英文、中文版本下载:http://www.yingyushijie.com/shop/source/detail/id/555.html